January 28-30, 2025

Borgata Hotel Casino & Spa • Atlantic City, NJ

The Microcap Conference has quickly become the largest independent microcap event in the United States. The three-day conference offers expert discussions on the latest market trends, one-on-one investor meetings, presenting company tracks, and non-stop networking paired with all the fun and excitement the Borgata in Atlantic City has to offer.

Our open admission policy means everyone can participate. And, we even extend a “plus-one” ticket, so attendees can bring a guest to experience all the entertainment and social activities the conference has to offer.

Companies, investors, and industry pros can schedule private meetings with investment targets or other attendees, leading to meaningful and very personal connections.

Microcap companies will present their business plans in discussion-style settings to provide an inside look at opportunities for collaboration or investment.

The event features non-stop networking and activities, all designed to offer the perfect blend of professional engagement and fun.

Engage with industry leaders at The Microcap Conference, where face-to-face meetings and personal interactions offer value beyond what’s possible through emails or virtual meetings. Shared experiences at DealFlow Events’ create a foundation of trust and camaraderie. Don’t miss this chance to build powerful business connections—join us and expand your own successful network.

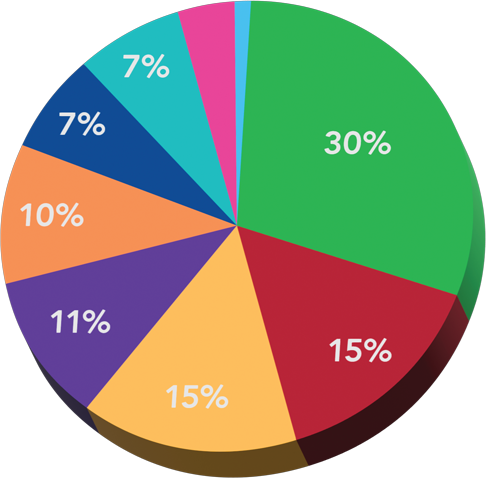

█ Healthcare/Pharma

█ Technology

█ Energy

█ Industrial/Manufacturing

█ Financial

█ Real Estate

█ Consumer/Media

█ Mining/Agriculture

█ Aerospace

The Microcap Conference offers a variety of social activities designed to promote networking and relationship-building.

If you’re coming to the 2025 conference, get ready to have a great time with friends and colleagues at our parties, networking breaks, meals, and gaming activities.

Select the applicable registration option and follow the instructions. You’re in!

Nearly half of last year’s attendees learned about the conference from a colleague or friend. So spread the word!

Adds ons include a 20 minute presentation, a video recording of your presentation, and a marketing table.

96% of 2024 attendees said the conference met or exceeded their expectations. The vast majority of attendees recommended this event to friends and colleagues.

Friends and family are welcome to attend the social activities including the pre-conference Launch Party, the After Party, and the freeroll poker tournament.

Check back for details.

Arrive relaxed when you hop on one of our executive party buses from Manhattan – refreshments included!

Kick off the event in style at the Premier Nightclub Launch Party featuring networking, drinks, music, and gambling.

Join us for an exciting night of live music, an open bar, and games.

Explore a diverse range of dining options to satisfy your culinary cravings.

End your stay in Atlantic city with a free-to-play poker tournament, featuring thousands in cash prizes. Last year this event sold out, don’t miss it!

The Microcap Conference is for companies looking to make professional connections, increase corporate awareness, and raise capital. Since these companies are such an important aspect of the event we’re setting up a 30,000 sq. ft. ballroom specifically designed for 1-on-1 meetings, powered by MeetMax software.

In advance of the conference, attendees will receive a program guide that features a summary of every participating company. These will include financial data and background information, in addition to contact information for the company’s executives. Using the MeetMax software, attendees can then schedule 20-minute meetings with companies of interest.

The Microcap Conference is a “destination event” that for many attendees is conveniently close to home in New York. The Borgata Hotel Casino & Spa provides luxurious guest rooms, swimming pool, and many other guest amenities. There is something new at every turn including a beautiful spa, great restaurants, and a massive gambling space serving as the perfect playground for our audience of deal-makers.

The Microcap Conference is a “destination event” that for many attendees is conveniently close to home in New York. The Borgata Hotel Casino & Spa provides luxurious guest rooms, swimming pool, and many other guest amenities. There is something new at every turn including a beautiful spa, great restaurants, and a massive gambling space serving as the perfect playground for our audience of deal-makers.

Missed last year’s event? Take a look at the featured companies, thought leaders, and sponsors that attended The Microcap Conference 2024.

© DealFlow Financial Products, Inc. (d/b/a DealFlow Events). All rights reserved. DealFlow Events™ and The Microcap Conference™ are trademarks of DealFlow Financial Products, Inc.

[Only bona fide journalists, reporters, and editors will be considered]

DealFlow Events will approve applications submitted by individuals representing institutions with the capabilities and intent to invest in microcap companies. Additionally, individuals with the means to privately invest in or purchase the stock of the microcap companies in attendance will also be considered.

Our research team will require a LinkedIn or online professional profile to verify all the information provided in your application before granting approval.

DealFlow Events will not approve individuals who are broker-dealers or licensed representatives of FINRA, nor will it approve individuals who own or work for advisory, consulting, law, accounting, insurance, or other financial services firms that offer services to microcap companies. This applies even if your intention is not to solicit your services at this event and you have the means to invest in microcap companies or purchase stock.

Don’t meet the qualifications? You can still attend! Register here to purchase your ticket.